House Prices in Dunedin: 2024 Report

Dunedin is one of the most affordable cities to live in New Zealand. It offers a great Kiwi lifestyle and reasonable house prices. If you are looking into moving to Dunedin, thus, buying a home, now it’s a great time, as prices are declining. However, interest rates are at all times high.

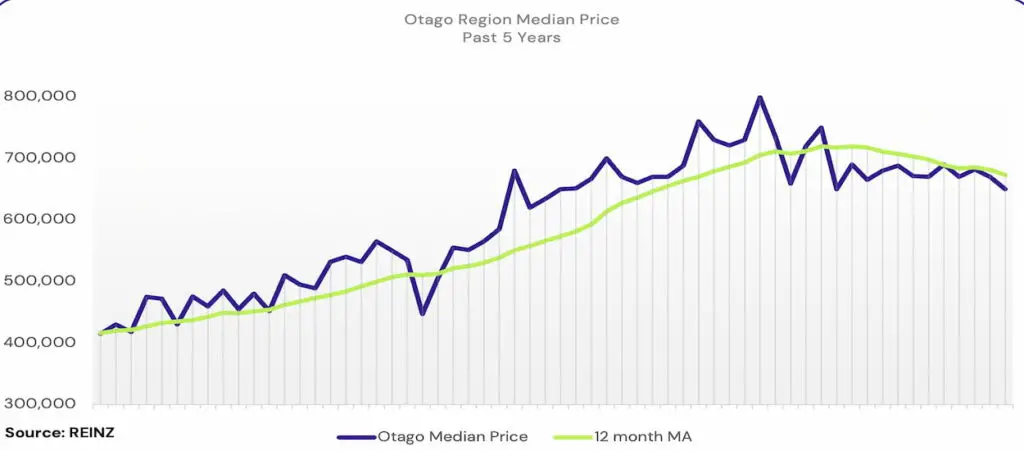

The current house pricing situation in Dunedin is that prices have been dropping steadily since late 2022. In June 2023, the median sale price of a home in Dunedin was $585,000 (-11,58%), at the same time, the average property value was $654,000 in May, down 11.3% from the previous year. The number of homes on the market has also increased, which is putting downward pressure on prices.

Whether you’re a potential homebuyer, an investor, or simply curious about the housing market, we’ve got you covered. Here are up-to-date insights on housing prices in Dunedin in August 2023.

The Reserve Bank of New Zealand has forecasted that house prices in Dunedin will continue to fall in the second half of 2023 before stabilizing in 2024. Here are some additional details about the current house pricing situation in Dunedin:

- The median sale price of a home in Dunedin has fallen by 11.58% in the past year.

- The number of homes on the market has increased by 100% in the past two months.

- The number of available listings decreased by 10% from June 2022.

- The number of sales has decreased by 25% in the past year.

- The average number of days a home spends on the market has increased from 52 to 57 days.

- Demand outweighs the supply – Dunedin sees a high competition for homes.

Read the pros and cons of living in Dunedin before you move there.

Average house prices in Dunedin in 2023

According to Reinz’s monthly report, the median sale price in Dunedin was $585,000 in June 2023. This figure is a good representation of the average house price in Dunedin. The median sale price in Dunedin city for June 2023 was 11,58%, down from June 2022.

Here are statistics about the housing market in Dunedin for June 2023 (Latest update: 26 Jul 2023) provided by the Real Estate Institute of New Zealand:

| June 2023 | June 2022 | |

|---|---|---|

| Median sale price | $585,000 | $639,000 |

| Number of listings | 498 | |

| Days on the market | 57 | 52 |

| Number of homes sold | 147 | 126 |

| Highest sale price | $2,190,000 | |

| Lowest sale price | $181,500 |

See the full report here.

The current house pricing situation in Dunedin, as of 2023, reveals interesting insights into the market. Local residents have witnessed the ebb and flow of the housing market in the city. It’s fascinating to see how Dunedin’s unique blend of natural beauty, educational excellence, and vibrant culture continues to attract people from all walks of life.

While the average house price of almost $600,000 may seem daunting to some, it’s important to remember that Dunedin offers various housing options to suit different budgets and preferences. When it comes to specific suburbs, there’s something for everyone.

In fact, homes in Dunedin are much more affordable than in other cities in the Otago region. Look at the Queenstown-Lakes with an average property value of $1,270,000 as of June 2023.

House prices vary depending on the suburb.

Through the streets of Roslyn, there are stunning properties that contribute to its status as the most expensive suburb in Dunedin, with an average house price of $932,500. On the other hand, South Dunedin’s affordability is a welcoming feature, with an average price of $417,500, making it an attractive option for first-time buyers or those seeking a more budget-friendly home.

Being part of a community that has seen firsthand the growth and changes in Dunedin’s neighborhoods, it’s important to note that Mornington has emerged as the suburb with the fastest growth rate in house prices. However, similar to many other locations in New Zealand, Mornington is experiencing a 21.1% decrease over the past year.

Meanwhile, Waverley has also faced a decline, with house prices experiencing a -17.76% growth rate. These variations remind us of the dynamic nature of the housing market, influenced by a multitude of factors such as demand, infrastructure development, and local amenities.

While the decline in house prices in Dunedin may be a cause for concern for some, it’s important to understand the underlying factors at play. Rising interest rates, a slowdown in economic growth, and an increase in the number of homes on the market have all contributed to the current downward trend.

However, the local real estate market is resilient and can undergo unexpected shifts. The Reserve Bank of New Zealand’s forecast of further price decreases in the second half of 2023, followed by stabilization in 2024, also highlights the ever-changing nature of the housing market.

As a potential buyer, staying well-informed about the current market conditions and trends is crucial. Do proper research on the areas (here are the best and worst suburbs) you’re interested in, seek professional advice if needed, and keep a close eye on the market.

Here are some additional resources where you can find more information about house prices in Dunedin:

Dunedin house prices by suburb

Here’s a list showcasing the median house prices for various suburbs in Dunedin in August 2023, based on data from the largest real estate websites, Oneroof.co.nz and Realestate.co.nz. Realestate.co.nz is the official website of the Real Estate Institute of NZ.

| Suburb | Median house price | 12mth change | Rental price | Capital growth | 36mth change | Rental yield |

|---|---|---|---|---|---|---|

| St Clair | $785,000 | -12.8% | $618/w | -4.03% | -14.19% | 3.8% |

| Mornington | $500,000 | -21.1% | $498/w | -6.06% | -14.03% | 4.03% |

| Roslyn | $932,500 | -8.1% | $600/w | -2.94% | -14.1% | 3.46% |

| Vauxhall | $875,000 | -1.5% | $600/w | 0,63% | -15.95% | 3.62% |

| North East Valley | $485,000 | -13.9% | $500/w | -3.88% | -10.92% | 3.89% |

| Maori Hill | $840,000 | -16.5% | $585/w | -4.28% | -14.72% | 3.33% |

| South Dunedin | $417,500 | -9.2% | $450/w | -4.95% | -11.09% | 4.91% |

| North Dunedin | $722,000 | +6.2% | $720/w | -2.78% | -11.49% | 4.29% |

| Andersons Bay | $660,000 | -6.4% | $560/w | -2.34% | -12.61% | 3.36% |

| Caversham | $455,000 | -13.3% | $455/w | -2.45% | -10.85% | 4.37% |

| Corstorphine | $488,000 | -23.3% | $528/w | -2.41% | -14.26% | 4.51% |

| Calton Hill | $485,500 | -12.2 % | $480/w | -3.43% | -12.04% | 4.22% |

Among Dunedin’s suburbs, Roslyn takes the crown as the most expensive, with a median house price of $932,500. Conversely, South Dunedin offers more affordable housing options, with a median house price of $417,500.

Only one neighborhood has seen an increase in home prices – North Dunedin, with +6.2% from the previous year. Corstorphine has witnessed the steepest decline in house prices over the past year, with a rate of -23.3%.

Now let’s take a look at the median house prices in Dunedin by property type:

- 2-bedroom: $375,000

- 3-bedroom: $500,000

- 4-bedroom: $625,000

- 5-bedroom: $750,000

While these figures provide a general idea of house prices, remember that actual prices can vary based on factors such as property size, condition, location, and view. The median price is a helpful starting point for understanding the market only.

Best and worst suburbs to buy a home

When it comes to buying a home in Dunedin, you want to ensure you’re making the right choice. Consider factors such as pricing, livability, and community amenities. Here are some of the best suburbs in Dunedin to consider:

St Clair: Positioned along the coast, St Clair captivates with its beautiful beaches, vibrant cafes, and restaurants. Although it has experienced a slight decline in house prices, the allure of coastal living remains intact. The median house price in St Clair is $785,000 in August 2023.

Mornington: Situated on the stunning Otago Peninsula, Mornington rewards residents with breathtaking city and ocean views. This suburb has experienced substantial growth in house prices, making it an appealing investment opportunity. The median house price in Mornington is $500,000.

Roslyn: Perched atop a hill, Roslyn is famous for its charming Victorian homes and panoramic city views. The steady growth in house prices showcases its desirability. The median house price in Roslyn is $932,500.

Vauxhall: Nestled a short distance from Dunedin, Vauxhall offers a range of amenities, including schools, shops, and restaurants. Despite experiencing a decline in house prices over the past year, it remains an attractive location. The median house price in Vauxhall is $875,000.

Maori Hill: This is the most expensive area to live in Dunedin, with an average house value of $840,000.

Saddle Hill: Offering wide open spaces and awe-inspiring vistas, Saddle Hill provides a tranquil retreat overlooking the city. The steady growth in house prices reflects the appeal of this suburb. The median house price in Saddle Hill is $740,000.

On the flip side, there are some suburbs that may not be as ideal for buying a home in Dunedin in 2023:

South Dunedin: Located in the southern part of the city, South Dunedin has industrial areas and a higher crime rate. Despite a slight decline in house prices, it still presents affordable options. The median house price in South Dunedin is $417,500.

Caversham: Situated on the eastern side, Caversham has a significant student population and is home to low-income families. It offers more affordable housing options. The median house price in Caversham is $455,000.

North East Valley: Characterized by steep hills and limited amenities, North East Valley may not suit everyone’s preferences. It remains a distinct neighborhood. The median house price in North East Valley is $675,000.

Andersons Bay: With narrow streets and limited parking, Andersons Bay may pose challenges for some buyers. Despite these challenges and a shortage of amenities, it attracts residents seeking a well-established community. The median house price in Andersons Bay is $660,000.

North Dunedin: Home to the University of Otago, North Dunedin draws in a vibrant student population. Although experiencing a slight decline in house prices, it remains a bustling and dynamic neighborhood. The median house price in North Dunedin is $722,000.

Before deciding, make sure you make a checklist of your requirements and then get what fits your needs. Dunedin has a lot to offer, something for everyone.

Should you buy a house in Dunedin?

One of the most significant factors driving the potential for growth in the Dunedin housing market is the city’s robust economy. Boasting thriving industries such as education, tourism, and healthcare, Dunedin is experiencing expansion, resulting in job creation and an influx of new residents.

Read this guide about house prices in New Zealand to explore your opportunities.

Furthermore, the limited housing supply in Dunedin could further bolster the housing market. There is a higher demand for homes in Dunedin than available inventory, leading to increased prices, competition, and other challenges for first-time homebuyers attempting to enter the market.

However, it’s essential to consider potential risks before buying a house in Dunedin. One notable risk is the relatively high unemployment rate compared to the national average, which stands at approximately 5%. This factor could pose challenges in finding jobs, potentially impacting the ability to meet mortgage obligations.

Ultimately, deciding whether to purchase a house in Dunedin is a personal one that should be carefully considered. Conduct thorough research, taking into account the positive and negative aspects mentioned.

Assess your budget, consider your specific housing needs, evaluate your desired lifestyle preferences, and factor in any future plans you may have regarding your stay in Dunedin.

In addition to these considerations, here are some additional points to reflect on when making your decision:

- Your budget: Determine the maximum amount you can comfortably afford to spend on a house.

- Your needs: Assess the specific requirements of your ideal home, including the desired number of bedrooms and bathrooms.

- Your lifestyle: Consider what is important to you in a home, such as proximity to amenities or the availability of a yard.

- Your future plans: Contemplate your long-term goals for staying in Dunedin. If your stay is temporary, renting may be a more suitable option.

If you decide to proceed with purchasing a house in Dunedin, it’s crucial to secure a favorable mortgage and develop a sound financial plan. Additionally, ensure that you familiarize yourself with the local laws and regulations about real estate to navigate the process smoothly. Read about the best places to buy a house in New Zealand.

![Cheapest Way To Build a House in New Zealand [2024]](https://simplenewzealand.com/wp-content/uploads/2023/04/new-zealand-g2792f4d95_1280-1-768x432.jpg)

![Guide To Buying Land in New Zealand [2024]](https://simplenewzealand.com/wp-content/uploads/2023/04/IMG_2664-1-768x576.jpg)

![Easiest Bank To Get A Home Loan in New Zealand [2024]](https://simplenewzealand.com/wp-content/uploads/2023/07/IMG_3646-min-1-1-768x576.jpg)